The University of Melbourne has a strong track record of transforming research into impactful solutions that benefit society.

From the invention of the life-changing Cochlear implant to Synchron’s brain-computer interface to the conservation of the world’s oldest Indigenous art collection, we understand we have a responsibility to not only conduct research but to also to make a difference in the world.

One of the ways we action this social responsibility is by translating research discoveries and innovations into startups and spin-out companies. We know that by transforming research findings into tangible products and services, we have the best chance of making an impact on people’s lives.

The mission of the Fund and the new Genesis Ventures team is to help world class researchers from the University of Melbourne and affiliated partners translate their discoveries and inventions to benefit society via a start-up pathway.

Hear from founders about 2023's six inspirational research startups:

What is the University of Melbourne Genesis Pre-Seed Fund?

The $15 million University of Melbourne Genesis Pre-Seed Fund is an investment fund designed to help researchers, students and alumni set up a startup, support it through the 'valley of death' and grow it into an investment-ready startup.

The Fund has been established in partnership with Breakthrough Victoria and provides financial investment, expertise, networks and mentoring for new University-affiliated startup companies.

This new fund plays a critical role in supporting University researchers to take more risks, to be more creative and to accelerate the translation of their research by entrepreneurial means. Genesis is co-funded by University of Melbourne and Breakthrough Victoria, an independent company managing the Victorian Government’s $2 billion Breakthrough Victoria Fund.

Up to 20 per cent of the Fund's capital is available for eligible Social Purpose Enterprises where:

- The investment will be used to create a viable, ongoing business model enabling social impact to be sustainable

- There is capacity to generate sufficient revenue to repay the investment over time.

The Fund and affiliated startups are supported by the Genesis Ventures team made up of University Investment Managers and Venture Creators.

The Genesis Ventures and Investment Team

The Genesis Ventures and Investment Team

What is pre-seed funding?

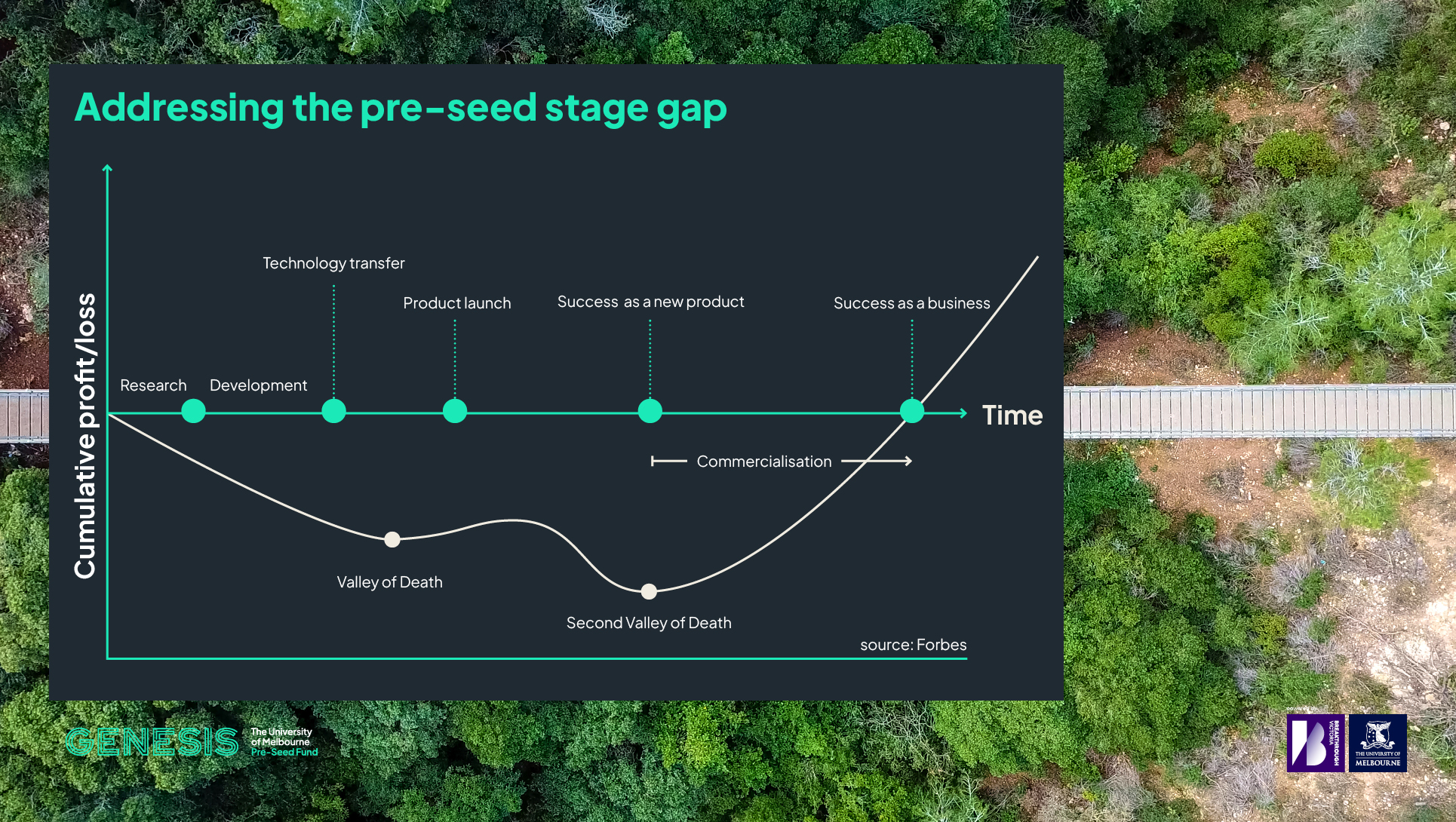

‘Pre-seed’ indicates the early stage of a startup lifecycle. Startups in this stage may be going through proof-of-concept, technology validation, prototype development, and product-market testing.

Addressing the pre-seed stage funding gap

Often this is the point where startups fail or fall into the first ‘Valley of Death’. The high-risk nature of this stage means it is often difficult to get funding from investors. The Fund and Genesis Ventures team wants to fill this gap so that great ideas can not only survive but thrive - and advance to the next stage of funding with external investors.

Addressing the funding gap as part of an end-to-end funding solution

Working in partnership with the University’s well-established entrepreneurial programs such as the Melbourne Accelerator Program (MAP) and Translating Research at Melbourne (TRAM), the Fund and the Genesis Ventures team provide important financial investment, specialised startup expertise and strategic support networks at this crucial early stage. We also work with strategic investment partners including Tin Alley Ventures, BioCurate, Uniseed, Brandon BioCatalyst, Main Sequence Ventures, Breakthrough Victoria and IP Group.

Learn more about working with the University of Melbourne Genesis Pre-Seed Fund and the Genesis Ventures team

-

Supporting founders

Genesis is a fund that provides pre-seed financial investment, but also has a support ecosystem designed to help startups succeed.

-

Apply for funding

How do I apply for Genesis Pre-Seed Fun support, and what will the assessment team be looking for?

-

Meet the investment team

Startup specialists, with experience in research, venture and entrepreneurship.

Our partner – Breakthrough Victoria

“The Breakthrough Victoria investment drives innovation and positions Victoria as a global leader in research and technology."

Grant Dooley, CEO of Breakthrough Victoria

Genesis is co-funded by University of Melbourne and Breakthrough Victoria, an independent company managing the Victorian Government’s $2 billion Breakthrough Victoria Fund which aims to create jobs, aid economic growth, as well as solving social issues and bolstering well-being for Victorians.

Breakthrough Victoria is investing in innovation for Impact to:

- Build the innovation ecosystem

- Create jobs and economic growth for the state

- Deliver financial and social impact returns

- Solve globally significant problems

- Improve health and wellbeing and boost productivity.

Contact us

Think Genesis Ventures and the Fund might be right for your research translation project?

Read some of our inspiring success stories

-

Kali Healthcare

Kali Healthcare, a University of Melbourne start-up, has developed a new wearable AI-powered device that provides better access to safe and accurate pregnancy monitoring both within the hospital and at home.

-

NIRGenie

A game-changing device accelerates intervention in infants and children with hearing and language disorders.

-

Torch Recruit

The University of Melbourne is collaborating with regional and rural GPs across the country to improve health outcomes, with the help of an innovative new platform.

First published on 1 February 2024.

Share this article